- August 11, 2017

- Posted by: Vincent Sarullo

- Category: Hedge Funds, How to Start a Hedge Fund

Start a Hedge Fund: Profitability Through Partnership

Common Values Yield Success

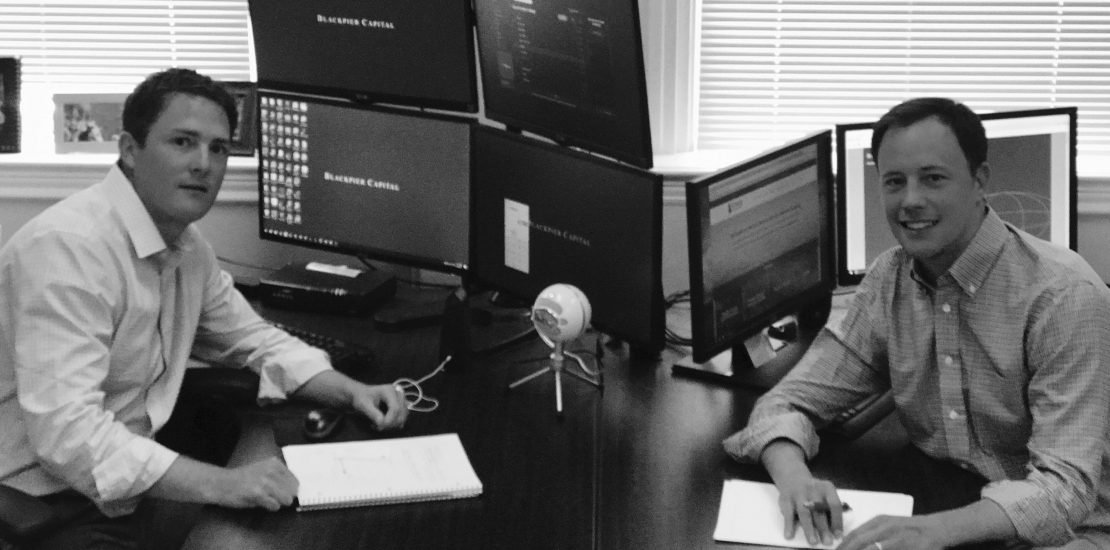

Options investing-focused Blackpier Capital, based in Knoxville, Tennessee, shares their inspiring story of aligning vision and gaining strength from teamwork. Blackpier partners Ryan Moffett and Zach Showalter understand that simple math of “1+1,” no longer equals “2” in today’s market. By combining their efforts they have enhanced the firm’s effectiveness and capital growth by much more than just the sum of two parts.

Having forged a successful performance-based fund, Blackpier Atlas, their shared vision allows them the opportunity to offer clients a unique investment option and their investors the peace of mind that Blackpier profits only when the fund provides returns.

They credit the firm’s success in large part to the accountability that comes from teamwork as well as playing to each other’s strengths. Ryan and Zach’s diverse and robust trading strategies have grown their fund and delivered consistently high returns to their clients.

Vision

Sharing the same vision, goal, and purpose, Ryan and Zach agree that without a unified core belief, a company cannot be successful. They also advise that making money for themselves cannot be a fund manager’s only goal, successful fund managers must have fundamental principles that inspire them.

“Blackpier Capital’s vision is based in transparency, aligned incentives, and growth. This is in conjunction with our client’s expectations of a high level of trust, accountability, and for our strategies to perform as outlined. Our approach may be uncommon for industry standards but seems to resonate with our potential and current investors which has been critical in building long term relationships.

We aspire to achieve transparency by walking clients through the step by step details of our strategies so they feel more comfortable with where it fits in their portfolio and how it is designed to work in all market environments. Investors are also offered monthly NAV video’s highlighting the performance, good or bad, and our perspective on the results. Blackpier Capital is 100% performance based and do not believe that we should get paid if we are not offering direct benefit to our clients. By creating a true partnership we fully align our incentives with client’s goals.

Finally, Blackpier built its strategies to yield tremendous upside when traditional portfolios are underperforming. We intend to provide enhanced returns that dispel the thought of passive only investing and reinforce the benefits of employing 5-10% of any portfolio in a liquid performance hedge. Each part of our vision has a fundamental basis and follows through in practice which provides us differentiation and frees us from the standard mold.”

Team

Team

As Ryan describes, the mental and physical capital from a team is not basic math. He asserts that teamwork allows for far greater gains. The right people are the multiplier to your success. Blackpier has added system developers and an execution specialist in consecutive years and it has made an enormous difference.

He also believes anytime you add someone to your team, you need to make sure they are a good personality fit. The team needs to enhance each other both personally and professionally.

“Accountability comes from a team,” Zach says. “It’s critical.”

Ryan agrees, “It’s huge. A team makes an exponential difference with accountability measures. You have to show up. Having someone else in the foxhole with you does make it easier.”

In Blackpier’s case, Ryan’s institutional background provides a knowledge base that enhances his ability to build and maintain an infrastructure for the team, including a process and a checklist. Conversely, Zach contributes his trading strategies, and focuses on garnering new clients while cultivating these strategies.

These two have fed off each other in a positive way. They are both “driven” and know what they want out of the industry. Ryan describes himself as “driven, process-oriented, and good in front of people.” Zach asserts that his strengths are in establishing relationships and developing a rapport with investors.”

“Your team picks you up when you are down,” says Ryan.

They encourage that opportunity is there, but it takes years of hard work and oftentimes learning the hard way. You can learn a lot about a person when they win, but you can tell everything about them when they lose.

Transition

People said without $500 million, a fund couldn’t be successful, but Ryan looked at his peers and saw they were trading successfully with $5 million a year. That was when he made the move to launch Blackpier Capital.

When Zach and Ryan began transitioning their teams of fund managers to align with Blackpier Capital, it involved making sure they were a good fit for each other first. Reviewing nuances to see how they could merge their investors and investment needs was also essential.

Ryan and Zach had to analyze personalities, strategies, marketing styles, legal documents, accounting practices, growth policies, and cost structures to assess their compatibility as well as review their individual client bases in order to provide their investors a seamless transfer during their new venture.

Would their visions align? They knew the only way to make things work would be to have a unified understanding. Their vision was that they wanted to give back to investors with a performance-based fund.

They recognized they had a common goal from the get go. Transitioning their clients with outreach was very difficult, but they said they wouldn’t have done it if they weren’t confident their strategies were the right fit.

Strategies

On a certain level, Zach feels clients are not just buying into the company’s strategies, but into him and his ability to make the best decision when investing their money. He feels fortunate that when he merged with Blackpier, all of his former clients had developed a deep enough confidence to stick with him through the transition.

Zach and Ryan acknowledge that trusting someone else’s strategy takes a long time. They eventually came to an agreement to maintain their strategies. The most important thing for Blackpier is to provide maximum profit to investors. Ryan says you need to know both sides of the venture, operations and strategy, and that you need to know strategies intimately.

“Coming from two opposite worlds, options and equities, certainly posed an initial challenge, but we have successfully united these to elevate Blackpier Capital. Our parallel direction and vision is, in fact, what drew us together. Our strengths lie in that we have both have a well-developed foundation of market knowledge, strategy creation, and risk management that span beyond specific instruments.”

“What separates us from other firms is our expertise within our niche. Our ability to assess and design options structures to devise multiple edges has proven very profitable over time. The addition of Zach’s outside perspective into Blackpier’s portfolios has provided a broader analysis and insight to risk, time frame, and position management.

Primary to our collective vision is developing a product first and building a team with a foundation in strategy development. Regardless of what financial tool is employed, we consistently arrive at the same conclusion. Simply put, process, portfolio analysis, and risk management are paramount to Blackpier Capital’s success. We have used our comprehensive backgrounds as a positive to offer insight and further our strategies to the immediate benefit of our investors.”

Technology

“We couldn’t run the fund like we do now ten years ago,” Ryan says. Now they operate from the office and electronically with WebEx and other resources that afford them the opportunity to collaborate across the country and work more efficiently.

“Technology such as real time video streaming, cloud based computing, and media dissemination have had a massive impact on the efficiency of Blackpier Capital even compared to 10 years ago. The location of our home office no longer dictates our ability to grow as a fund. We have been able to assemble an institutional grade team, with traders on the west coast, a top notch administrator in Tower Funds Services, and the ability to reach potential investors across the globe. To achieve this we utilize Webex, to communicate with traders daily, podcasts and blogs to reach potential clients, on top of advanced software that allows us to analyze and execute our strategies with maximum efficiency. Being able to harness the incredible number of tools available affords even smaller funds the ability to thrive outside of traditional financial hubs.”

They have used podcasting technology to expand their network. After Ryan was interviewed in Chat with Traders, he was introduced to his newest trader. Listen to the podcast here:

Background

Both Ryan Moffett and Zach Showalter are from Knoxville, Tennessee and played on the same soccer team as children. They eventually went their separate ways for college, but later reunited in Knoxville after gaining education and experience in finance.

Ryan Moffett is the lead manager of the Blackpier Atlas Portfolio of Strategies spending the last 12 years specializing in designing and trading robust systems and strategies. In those 12 years he has worked with and been mentored by traders out of the CBOE as well alternative hedge fund managers out of New York and California. Prior to managing Blackpier Capital, he worked for a $2 billion investment firm, working from operations to leading a team in investments strategy and portfolio construction as well as a small alternative investment advisor with $40 million in assets. Ryan holds an MBA from The University of Tennessee with a concentration in Finance and Portfolio Management.

Ryan’s experience was with a performance-based pit-trading firm where traders do not make money unless their investors make money. That experience informed his management of Blackpier Capital where their income is not guaranteed – all of their income is performance-based.

Zachary Showalter brings 17 years of money management and strategy development experience to the Blackpier Capital team. Having established his own alternative asset trading firm in Chicago at the age of 22, he successfully navigated the capital markets and consistently generated positive returns on a portfolio of up to $20 million. Employing a comprehensive understanding of equity and options markets, he implemented and refined proprietary strategies through all market environments. Zach leveraged that experience, becoming the principal manager at Showalter Capital before joining forces with Blackpier Capital. He is currently focusing on business development, capital expansion, and strategy consulting. Zach holds a Bachelor of Science from Miami University in Oxford, Ohio with a concentration in finance.

After 9/11, strategies disappeared with market fluctuation, so he and his colleagues started their own fund. Over the years, these experiences helped Zach learn, “how to put one foot in front of the other and not get discouraged when the legal documents don’t come back or you don’t get a client.”

Guidance with Starting a Hedge Fund

To learn more about Blackpier Capital, visit their website: http://www.blackpiercapital.com/.

Starting a hedge fund? Tower Fund Services can provide guidance for emerging fund managers. Blackpier Capital is just one of the many emerging funds Tower has worked with. Tower regularly holds AIM to Close events nationwide where fund managers meet to share their strategies and success stories. Learn more about our events on our events page.

Starting a hedge fund? Contact us at 732-704-7297 today.